- #Texas ag exemption form pdf#

- #Texas ag exemption form drivers#

- #Texas ag exemption form registration#

Guidelines and regulations regarding tax exemptions may vary between states. Texas Comptroller Appraisal Protest and Appeals publications & Videos click here Statement of Ownership and Location TDHCA FORM.

#Texas ag exemption form registration#

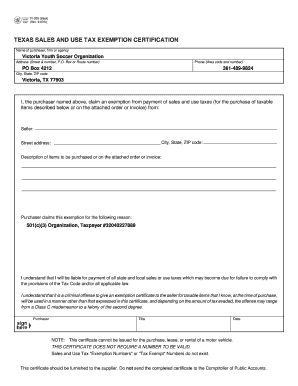

DPA Auctions will not be held liable for States’ registration requirements in regards to exemptions. vehicle tax exemption, you must give a properly completed Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form 14-319) to the vehicle’s seller or dealer.

#Texas ag exemption form pdf#

Wildlife Management Annual Report (PWD-888) PDF for county tax office. DO NOT send this form to Texas Parks and Wildlife Department. For eligibility questions, please contact your tax consultant. You cannot use this form to claim exemption from motor vehicle tax when buying motor vehicles, including trailers. Wildlife Management Plan for agricultural tax valuation (PWD-885) WORD (fillable) Use this form to submit your wildlife management plan to your county Central Appraisal District. Use tax is based on the OHV’s original sales price and can be remitted by submitting Form 01-156, Texas Use Tax Return (PDF), along with a use tax payment to the Comptroller’s office. DPA Auctions cannot offer advice, opinions or guarantees about whether a Bidder is, in fact, tax exempt. When an OHV purchased tax free under an agricultural or timber exemption loses the exemption, use tax is due. Law requires that exemption forms are auction specific and will need to be completed for each individual auction. Please complete the exemption form from the state in which the item(s) is located, not the location of the purchaser. Most Texas landowners are familiar with the provision in the Texas Property Code dealing with agricultural appraisal of Texas land. This proof of tax exemption must be submitted before tax amounts will be removed from the invoice. A 1-d-1 Appraisal is Also Known as an Ag Exemption. Tax will be collected on all applicable items unless the Buyer provides proof of tax exemption. Texas Comptroller Appraisal Protest and Appeals publications & Videos click here. Tax rates will be based on the item’s location. Exemptions: Forms: BPP Depreciation: HB3693 Utility Report: Understanding the Property Tax Process. Agriculture: 50-129 Application for 1-d-1 Agricultural Use Appraisal. Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations.įor a complete list of forms please visit the Texas State Comptroller’s website.DPA Auctions is required by law to collect sales tax on all applicable transactions. Cleburne, Texas 76033 Phone: (817) 648-3000 Fax: (817) 645-3105. Download your updated document, export it to the cloud. Get the Application for texas agriculture exemption form ap 228 accomplished. An agricultural or timber exemption certificate is required when you claim a sales tax exemption on the purchase of items directly used to produce agricultural.

Quickly add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from your document. Ag Advisory Board Minutes Ag Policies and Procedures Holiday Schedule Utility.

#Texas ag exemption form drivers#

All homestead applications must be accompanied by a copy of applicant’s drivers license or other information as required by the Texas Property Tax Code. Edit Application for texas agriculture exemption form ap 228. Other Texas Property Tax Forms available Here.

0 kommentar(er)

0 kommentar(er)